Thanusiga Thanabalasingam

• Easily Onboard Users: Offer a variety of account options that fit the requirements of individuals or businesses.

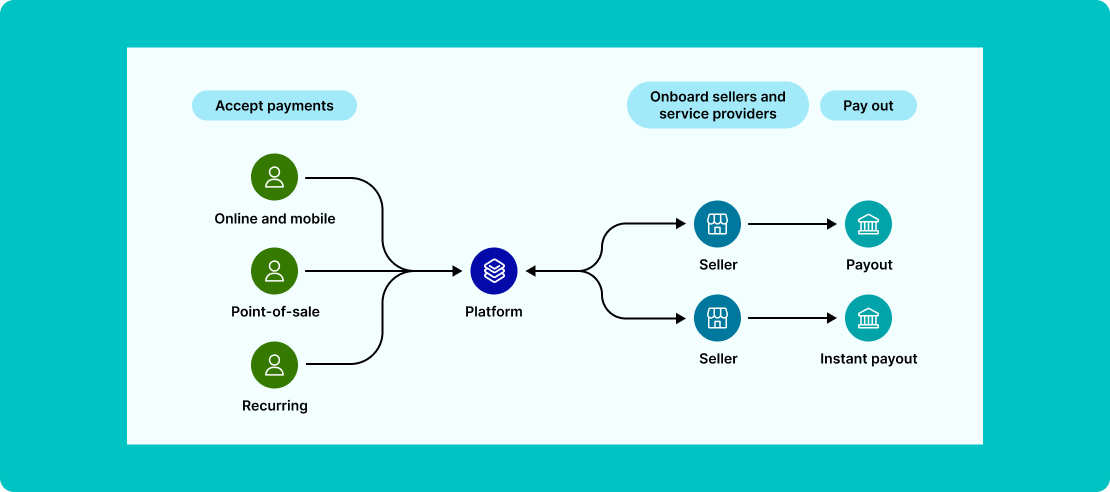

• Handle Payments Securely: Collect money from customers and distribute payouts efficiently.

• Ensure Compliance: Automate KYC (Know Your Customer), tax reporting, and financial regulations.

• Operational Simplicity: Reduces complexity in multi-party payment processing.

• Global Capabilities: Supports multi-currency transactions and international operations.

• Compliance and Security: Automates tax reporting, KYC, and adherence to PCI compliance standards.

• Scalability: Grows with your business, handling high transaction volumes effortlessly.

• Use Stripe’s API: Generate login links for user onboarding.

• Provide Dashboard Access: Allow connected accounts to manage their payment details.

Schedule payouts to customers' Bank Accounts or Cards:

• Regular Payouts: Send funds at scheduled intervals.

• Instant Payouts: Enable faster fund transfers to eligible accounts (with additional charges).

• Operational Simplicity: Reduces complexity in multi-party payment processing.

• Global Capabilities: Supports multi-currency transactions and international operations.

• Compliance and Security: Automates tax reporting, KYC, and adherence to PCI compliance standards.

• Scalability: Grows with your business, handling high transaction volumes effortlessly.